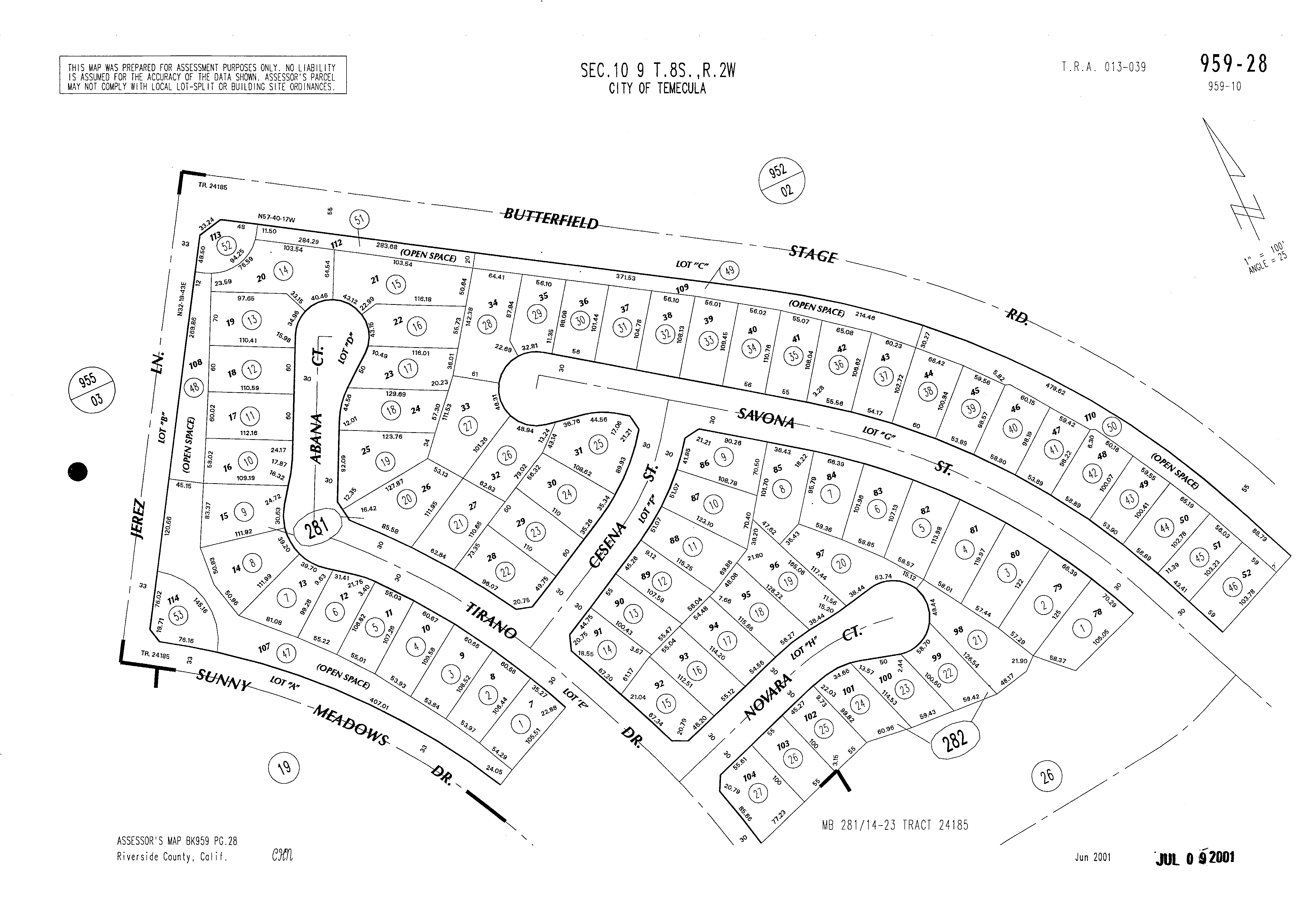

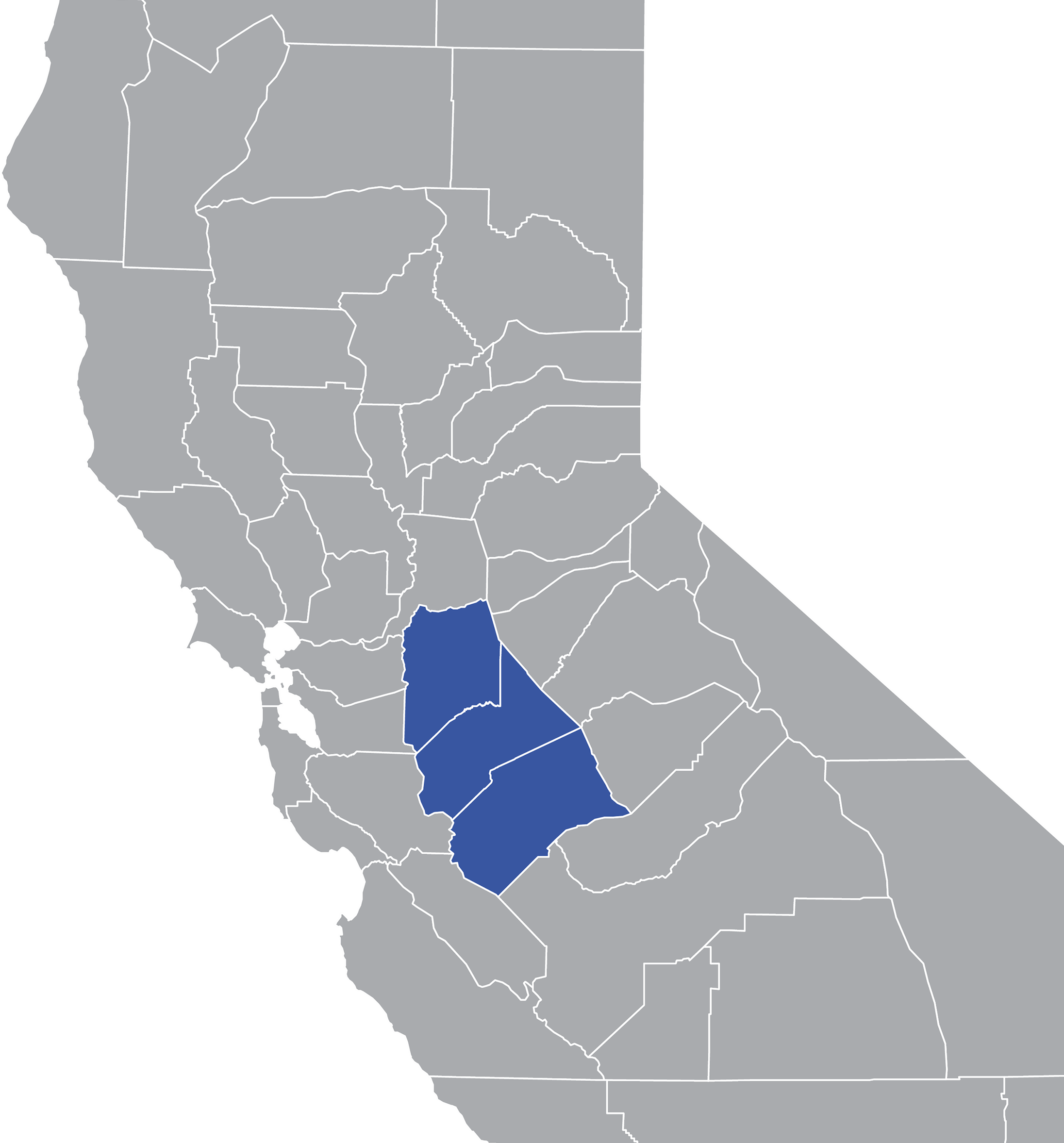

Webthe median property tax in san joaquin county, california is $2,340 per year for a home worth the median value of $318,600. San joaquin county collects, on average, 0. 73% of. Our mission is to ensure the safekeeping of public funds while. Webexplore the charts below for quick facts on san joaquin county effective tax rates, median real estate taxes paid, home values, income levels and homeownership rates, and. Weblearn all about san joaquin real estate tax. Whether you are already a resident or just considering moving to san joaquin to live or invest in real estate, estimate local. Webthe median property tax (also known as real estate tax) in san joaquin county is $2,340. 00 per year, based on a median home value of $318,600. 00 and a median effective. Weboverseeing the property tax billing and collection process for secured and unsecured property taxes levied by california state law, we assist the public in understanding their. Quickly find treasurer & tax collector phone number, directions & services (stockton, ca).

Related Posts

Recent Post

- Facebook Marketplace Mt Pleasant Pa

- Ups Drop Off Store Locator

- Ballard County Busted Newspaper

- Boruto The Way Pervert Ninja

- Wendigoon Ethnicity

- Bryan Reynolds Baseball Savant

- Dish Careers Denver

- 3kh0 Smash Karts

- Medical Courier Independent Driver

- Qvc This Morning Show

- Citrus County Sheriffs Office Arrests

- Volusia County Jail Daytona Mugshots

- Soap Dirty Laundry Gh

- Getinthecar Twitter

- Nf Gazette Obituaries

Trending Keywords

Recent Search

- Osceola Daily

- Travel Phlebotomy Jobs In Florida

- Nj Dmv Inspection Appointment

- Space Coast Daily Mugshots Brevard County

- Babysitting Jobs No Car Needed

- Danielle Colby Daughter Memphis

- Funeral Homes Wetumpka Al

- Craigslist Cash Jobs Houston

- Facebook Marketplace Inver Grove Heights

- Accident On 44 Westbound Today

- Nail Salon Mentor

- Mon Valley Obituaries For Today

- Dr Sandra Lee Height

- Micheals Arts Crafts

- Papa John Nearby

/state-income-tax-rates-2-2014-tax-foundation-57a631e35f9b58974a3ad3a4.png)